Business owners who keep a chart of accounts handy will have an advantage when it comes to accounting. An added bonus of having a properly organized chart of accounts is that it simplifies tax season. The COA tracks your business income and expenses, which you’ll need to report on your income tax return every year. With online accounting software, you can organize and track your balance sheet accounts. No matter if you’re an entrepreneur starting a business or an owner looking to streamline your practices, accounting software can help you get the job done.

Managing Cash Flow: A Comprehensive Guide for Small Business Finances

Without a chart of accounts, it’s impossible to know where your business’s money is. The chart of accounts is like a map of your business and its various financial parts. Back when we did everything on paper, or if you’re using a system like Excel for your bookkeeping and accounting, you used to have to pick and organize these numbers yourself. But because most accounting software these days will generate these for you automatically, you don’t have to worry about selecting reference numbers. Revenue accounts keep track of any income your business brings in from the sale of goods, services or rent.

How to Do Bookkeeping For Shopify – Essencial Shopify Bookkeeping Guide

The chart of accounts allows you to organize your business’s complex financial data and distill it into clear, logical account types. It also lays the foundation for all your business’s important financial reports. You can think of this like a rolodex of accounts that the bookkeeper and the accounting software can use to record transactions, make reports, and prepare financial statements throughout the year. This categorization goes beyond merely adhering to accounting standards; it aligns with your business’s operational needs. For example, manufacturing businesses may require detailed accounts for inventory and cost of goods sold, whereas service-based businesses might prioritize expense accounts related to service delivery. Interim accounts, also known as temporary accounts, track financial activities for a specific accounting period.

Income Statement

The total equity amount reflects the company’s net worth or book value, which is the value of the assets minus the liabilities. Every transaction affects at least two accounts – one gets debited and another credited. Double-entry bookkeeping is a fundamental requirement for recording financial transactions under GAAP (Generally Accepted Accounting Principles), so you can’t record your transactions differently. It’s a fundamental accounting framework you use to organize your financial records and build reporting around. The relationship between journal entries and the chart of accounts is akin to the relationship between a script and its cast of characters. The COA serves as the cast—a structured list of all accounts where financial transactions can be recorded.

Tracking liability accounts is vital for assessing a company’s financial obligations and its ability to settle debts. Asset accounts consist of tangible and intangible resources owned by a business. These can include cash, accounts receivable, inventory, property, equipment, investments, and intellectual property. Asset accounts are crucial in determining a company’s financial health and its ability to meet short- and long-term obligations. Plus, keeping an eye on different expense types helps the company control its costs and ensure money is spent where it matters most.

- It provides a detailed framework for analyzing past transactions, invaluable for projecting future financial performance.

- Similarly, if you use an online program that helps you manage all your accounts in one place, like Mint or Personal Capital, you’re looking at basically the same thing as a company’s COA.

- A chart of accounts is an important organizational tool in the form of a list of all the names of the accounts a company has included in its general ledger.

- Utilizing accounting tools like these will ensure a better workflow, helping you grow your company.

- So, when setting up your accounting system, you create the COA in this order.

Operating Revenue Accounts

To understand the chart of accounts, you might want to look at the concepts of accounts and general ledger. As I close, let me encourage you to give your chart of account decisions plenty of thought. If you don’t give your chart of the 20 best excel formulas for managing your product inventory accounts the early love it deserves, you may regret it. Creating a new accounting systems six years out, for example, would be a major headache. First, let’s look at how the chart of accounts and journal entries work together.

Our team is ready to learn about your business and guide you to the right solution. Revenue is the amount of money your business brings in by selling its products or services to clients. Marshall Hargrave is a financial writer with over 15 years of expertise spanning the finance and investing fields. He has experience as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and National Venture Capital Association. Marshall is a former Securities & Exchange Commission-registered investment adviser and holds a Bachelor’s degree in finance from Appalachian State University. These numbers are typically four digits, and each account has a unique number.

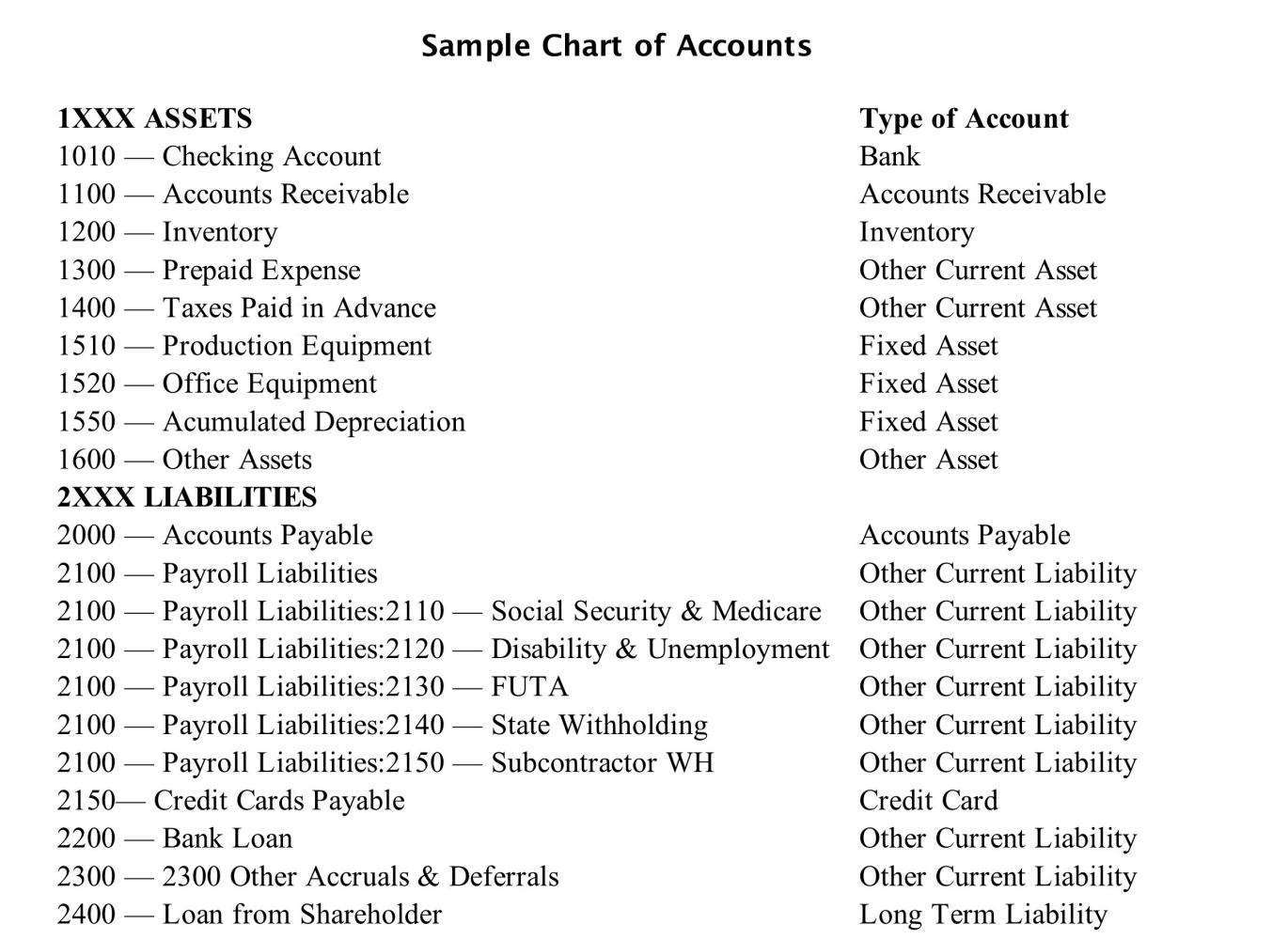

For example, if the first digit is a “1” it is an asset, if the first digit is a “3” it is a revenue account, etc. The company decided to include a column to indicate whether a debit or credit will increase the amount in the account. This sample chart of accounts also includes a column containing a description of each account in order to assist in the selection of the most appropriate account. With real-time reporting capabilities, AP automation solutions provide immediate access to financial data, facilitating quick and informed decision-making. They also support compliance efforts by keeping up with the latest accounting standards and tax laws. Unique numbers assigned to accounts enable easy identification and classification.

But the final structure and look will depend on the type of business and its size. An expense account balance, for example, shows how much money has been spent to operate your business, whereas a liabilities account balance shows how much money your business still owes. A chart of accounts is a critical tool for tracking your business’s funds, especially as your company grows.

So, why would you add these additional layers in the chart of account number? Additional account coding can make it easier to create financial statements. For example, in the preceding table, total cash can be determined by adding all accounts preceded with 10-10. The structure of the chart of accounts makes it easier to locate specific accounts, facilitates consistent posting of journal entries, and enables efficient management of financial information over time. For example, a company may decide to code assets from 100 to 199, liabilities from 200 to 299, equity from 300 to 399, and so forth. Those could then be broken down further into, e.g., current assets ( ) and current liabilities ( ).

In addition to assisting with financial statement creation, there are other advantages to using a chart of accounts. Now, the trial balance (the summary of all account balances) checking account balance reflects $125,453 at the end of May which is included in the financial statements. But you need to understand this part of bookkeeping and accounting whether you use a manual system or an online one such as QuickBooks. A chart of accounts is helpful whether you are using FASB, GASB, or special purpose frameworks. The most important component when working with a chart of accounts is consistency, which enables the comparison of financials across multiple accounting periods and business units.